nd tax commissioner forms

MMDDYYYY Amount of payment by check Mail entire page to. North Dakota Office of State Tax Commissioner 2016 Form ND-1 page 2 19.

/cloudfront-us-east-1.images.arcpublishing.com/gray/L2DHVMGADVGFFIBXHV2YOKXXDU.jpg)

Blizzard Prompts Tax Commissioner To Extend Filing Deadline For North Dakotans

We will update this page with a new version of the form for 2023 as soon as it is made available by the North Dakota government.

. Income tax withholding tables are also available on the new site at wwwtaxndgovIncomeTaxWithholding. The North Dakota Office of State Tax Commissioner is pleased to announce the launch of its new website wwwtaxndgov. Form 40-UT - Underpayment of Estimated North Dakota Income Tax by Corporations.

If taxpayers need help locating forms they can call 701-328-1243. If you dont have an account yet register. Engineering and Materials Testing.

See page 16 of instructions IIT. If approved the North Dakota return can be marked to indicate that the extension has been granted as above. Wwwndgovtax E-mail Individual estate and trust income tax individualtaxndgov Call Questions 701 328-1258 Forms 701 328-1243 Speechhearing impaired TDD 800 366-6888 Write Offi ce of State Tax Commissioner 600 E.

Add lines 1b and 5a 5b AE 23 SQ 30 AK AL 2019 Form ND-1 SFN 28702 12-2019 Page 2. Schedule ND1-PG - Planned Gift Tax Credit. Form 40-EXT - Corporate Extension Payment Voucher.

Schedule FACT Schedule K Schedule KP Schedule K-1 Dear Taxpayer Form 58 the North Dakota Partnership Income Tax Return may be filed electronically through the Modernized E-File MeF system. The 2021 North Dakota Legislature created a tax relief income tax credit for. FORM 306 - INCOME TAX WITHHOLDING RETURN NORTH DAKOTA OFFICE OF STATE TAX COMMISSIONER SFN 28229 3-2019 A Fill in this circle if this is an amended return.

Schedule ND-1CS - Calculation of Tax proceeds from Sale of Income Tax Credit. Form 40-QR - Application for Quick Refund of Overpayment of Estimated Income Tax for Corporations. Statutory adjustments This schedule is to be used by all corporations regardless of filing method.

Dear Taxpayer 2009 was a year of signifi cant changes to the individual income tax. The most meaningful change is the reduction in income tax rates which will provide 45 milli. 2019 Forms Order ND Office of State Tax Commissioner 600 E Boulevard Ave Dept 127 Bismarck ND 58505-0599.

You can download forms and fi nd other information on our web site at. Online tax return filing system. NORTH DAKOTA OFFICE OF STATE TAX COMMISSIONER SFN 28702 12-2019 Date Of Death b.

Marriage penalty credit for joint filers From worksheet on page 14 of instructions 24. Form ND-1ES - 2022 Estimated Individual Income Tax. North Dakota has a state income tax that ranges between 1100 and 2900.

Schedule ND-1UT - Underpayment of Estimated Individual Income Tax. Administration of North Dakota tax laws. A charitable gaming organization that has a state gaming license must file a North Dakota gaming tax return for each quarter the organization is licensed even if there was no gaming activity during the quarter.

North Dakota Office of State Tax Commissioner Claim for Refund Local Sales Tax Paid Beyond Maximum Tax not to be used for incentive exem ptions or to amend a sales tax return 21944 Form revised 0116 Name Social Security Number or Federal Employer Identification Number Address City Zip Code. Schedule ND-1FC - Family Member Care Credit. MeF allows the North Dakota and federal partnership returns to be.

Detach here and mail with payment FORM ND-1PRV INDIVIDUAL PAPER RETURN PAYMENT VOUCHER NORTH DAKOTA OFFICE OF STATE TAX COMMISSIONER SFN 28756 12-2019 2019. Engineering and Materials Testing. With the launch of the new website also comes the release of the 2021 North Dakota income tax booklets and income tax forms and the 2022 income tax withholding tables.

Form 40X - Amended Corporation Income Tax Return. ND State Tax Commissioner What is Form ND-1PRV. North Dakota Office of State Tax Commissioner PO Box 5624 Bismarck ND 58506-5624 WTH.

Credit for income tax paid to another state or local jurisdiction Attach Schedule ND-1CR 22. We last updated North Dakota Schedule ND-1NR in February 2022 from the North Dakota Office of State Tax Commissioner. This form is for income earned in tax year 2021 with tax returns due in April 2022.

Failure to provide the social security number or FEIN may delay or prevent the processing of this form. Add lines 21 through 23. Search for the document you need to.

TaxFormFinder provides printable PDF copies of 45 current North Dakota income tax forms. Disclosure authorization-I authorize the ND Office of State Tax Commissioner to discuss this return with the paid preparer identified below. Office of State Tax Commissioner PO Box 5622 Bismarck ND 58506-5622 2022 Make payable to.

ND State Tax Commissioner Write last four digits of social security number and 2022 ND-1ES on check IIT Detach here and mail with payment FORM ND-1ES INDIVIDUAL ESTIMATED TAX PAYMENT. City State ZIP Code Payment Amount Mail payment and voucher to. The 2019 Form ND-1PRV is a payment voucher that you.

North Dakota Office of State Tax Commissioner 2010 Form 40 page 2 Name as shown on return Schedule SA. Income tax booklets and forms can be found on the new website at wwwtaxndgovforms. North Dakota state income tax Form ND-1 must be postmarked by April 18 2022 in order to avoid penalties and late fees.

Tax Commissioner Reminds Taxpayers of Extension Deadline. The current tax year is 2021 and most states will release updated tax forms between January and April of 2022. Printable North Dakota state tax forms.

20 rows Free printable and fillable 2021 North Dakota Form ND-1 and 2021 North Dakota Form ND-1 Instructions booklet in PDF format to fill in print and mail your state income tax return due April 18 2022. North Dakota has a state income tax that ranges between 11 and 29 which is administered by the North Dakota Office of State Tax Commissioner. Additions 1 Federal net operating loss deduction Federal Form 1120 line 29a 2 Special deductions Federal Form 1120 line 29b.

Fill in the circles that apply. Get fillable online nd ce of state tax commissioner form nd signed right from your smartphone using these six tips. Ryan Rauschenberger Tax Commissioner 2014 Partnership Income Tax Form 58 Includes.

Form ND-1EXT - 2021 Extension Payment Form. Form 40-ES - 2021 Estimated Tax Form. The current tax year is 2021 with tax returns due in April 2022.

Form 101 can be obtained by calling the Office of State Tax Commissioner at 701-328-1243 or by mail here. Enter your North Dakota taxable income from line 18 of page 1 21. 1099-G consent-I agree to obtain Form 1099-G electronically at wwwndgovtax.

127 Bismarck ND 58505-0599 Offi ce. Account Number Due Date of Return Ex.

State Tax Commissioner Rauschenberger Will Resign News Dakota

Brian Kroshus Appointed N D Tax Commissioner News Dakota

Free North Dakota Tax Power Of Attorney Form 500 Pdf Eforms

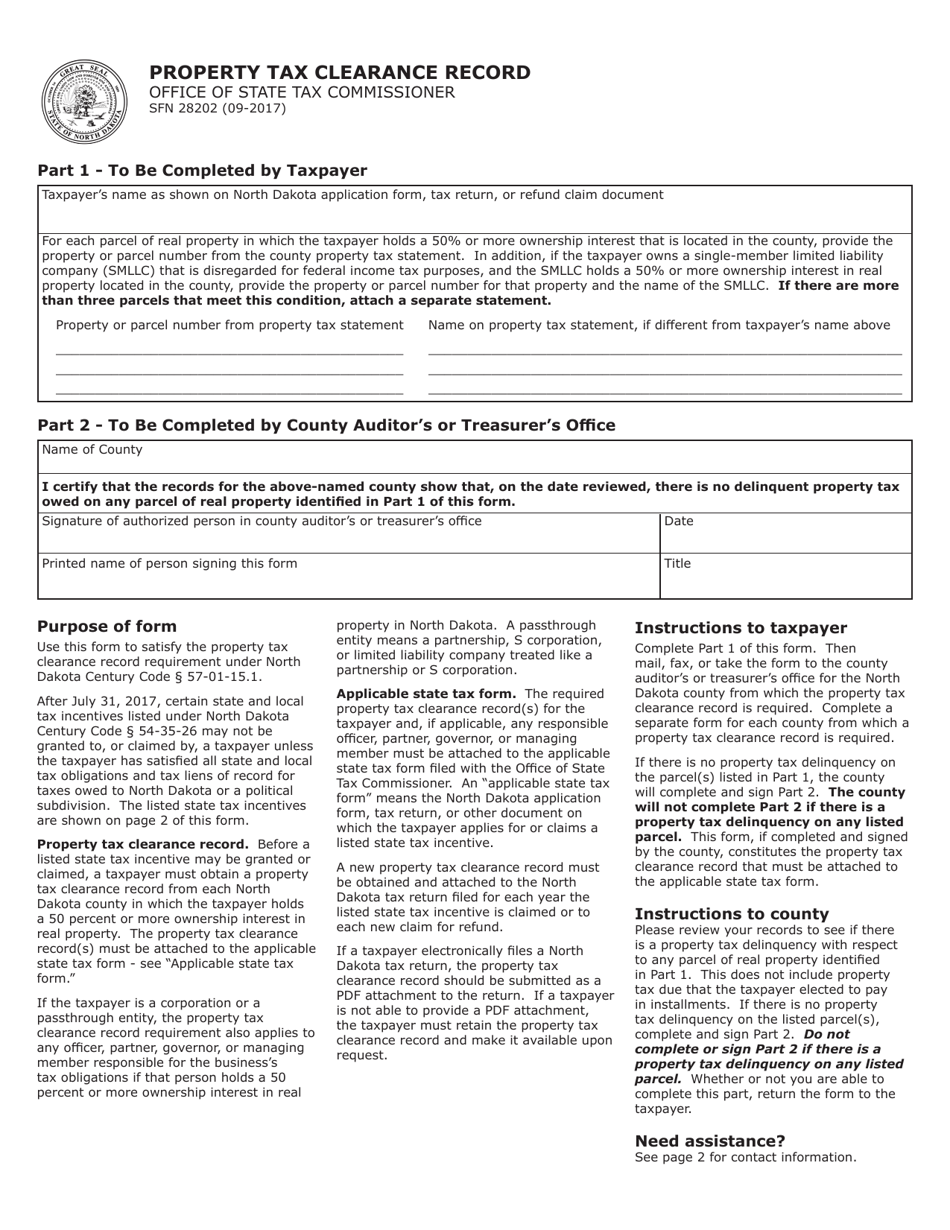

Form Sfn28202 Download Fillable Pdf Or Fill Online Property Tax Clearance Record North Dakota Templateroller

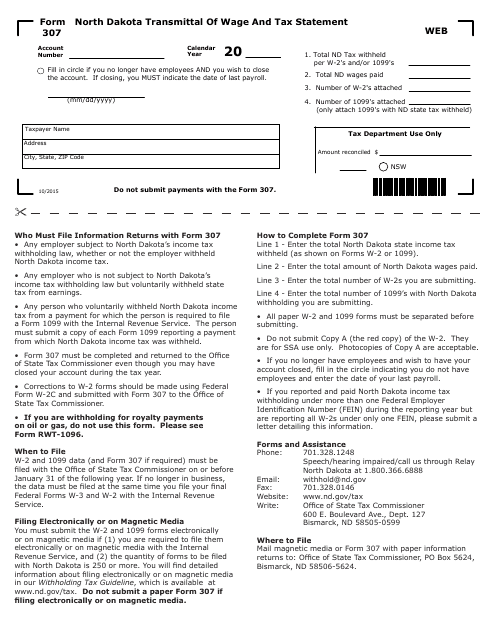

Form 307 Download Fillable Pdf Or Fill Online North Dakota Transmittal Of Wage And Tax Statement North Dakota Templateroller

Voters Could Make Tax Assessor An Appointed Position Medford News Weather Sports Breaking News Mail Tribune

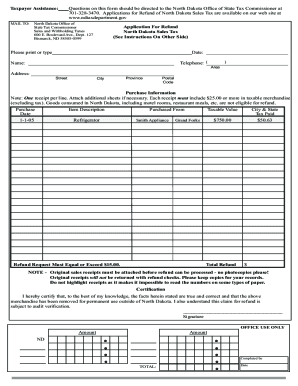

Form 21944 Download Fillable Pdf Or Fill Online Claim For Refund Local Sales Tax Paid Beyond Maximum Tax North Dakota Templateroller

Form 40 Qr 28755 Download Fillable Pdf Or Fill Online Application For Quick Refund Of Overpayment Of Estimated Income Tax For Corporations North Dakota Templateroller

Tax Commissioner Ben Hill County

North Dakota Tax Refund Canada Fill Out And Sign Printable Pdf Template Signnow

Free North Dakota Tax Power Of Attorney Form 500 Pdf Eforms

Free North Dakota Tax Power Of Attorney Form 500 Pdf Eforms

/cloudfront-us-east-1.images.arcpublishing.com/gray/L2DHVMGADVGFFIBXHV2YOKXXDU.jpg)

Blizzard Prompts Tax Commissioner To Extend Filing Deadline For North Dakotans

Nd Tax Website Revamped In Time For Tax Season